Instead of Moving, Consider Improving Your Home

If you own your home and have a mortgage, a cash-out refinancing option may be an easy way to have the money to tackle your home improvement project. Since interest rates are still quite low now may be a good time to tap into your home's equity. Many homeowners may not realize that cash-out refinancing can help fund these projects. A cash-out refinance is not a second mortgage. It is borrowing against the equity in your home or money you have already paid towards your mortgage. A cash-out refinance will require that you refinance your home most likely at a lower rate. The new loan amount will be slightly more than the remaining balance of your home because it will include the amount of cash you take out for you or your family.

Cash-out refinancing is beneficial because it can increase monthly cash flow and allow you to make good use of the funds you take out, according to Freedom Mortgage, one of the nation's full-service mortgage lending company and a leader in FHA and VA loans according to Inside Mortgage Finance, 2020.

The benefits of cash-out refinancing aren't limited to home improvements. Funds from a cash-out refinancing also can be used to pay for a college education or to consolidate high-interest debts at a lower interest rate. Homeowners can typically borrow up to 80% of the value of their homes without paying the private mortgage insurance (PMI) required by some lending situations. That means if you have more than 20% equity in your home, you can use that equity to get cash now.

To help homeowners explore their options and determine how much cash they can obtain, Freedom Mortgage offers a free cash-out refinancing calculator that enables the user to determine what makes sense and the amount of their new monthly payment.

For more information, visit https://www.freedommortgage.com/cash-out-refinance.

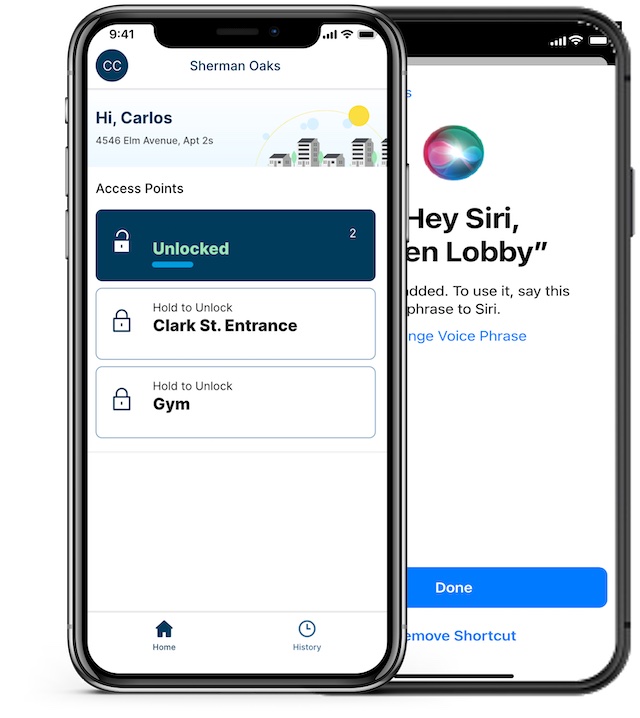

- Today’s Millennial and Gen Z apartment hunters are tech-savvy, smart and safety-conscious. That means they are seeking the best in high-tech features that make their lives easier, safer and more fun, and they are willing to pay more for it. Parks Associates’ research on multifamily property owners shows that a third of residents are willing to pay an additional 15% per month in rent for smart amenities.

- Today’s Millennial and Gen Z apartment hunters are tech-savvy, smart and safety-conscious. That means they are seeking the best in high-tech features that make their lives easier, safer and more fun, and they are willing to pay more for it. Parks Associates’ research on multifamily property owners shows that a third of residents are willing to pay an additional 15% per month in rent for smart amenities.

-

-

- It’s outdoor living season and there’s nothing better than kicking back and enjoying some fun in the sun with family and friends. And whether you’re looking to build an open-air space to relax, or the outdoor kitchen of your dreams, natural materials like cypress canI make a bold design statement and withstand the elements.

- It’s outdoor living season and there’s nothing better than kicking back and enjoying some fun in the sun with family and friends. And whether you’re looking to build an open-air space to relax, or the outdoor kitchen of your dreams, natural materials like cypress canI make a bold design statement and withstand the elements.

- Whether you are a recent college graduate, a grad student in a new city or a young professional shifting gears into a new job, finding your first home as an independent adult can seem daunting, but a few key points can put you on the path to your own place.

- Whether you are a recent college graduate, a grad student in a new city or a young professional shifting gears into a new job, finding your first home as an independent adult can seem daunting, but a few key points can put you on the path to your own place.  - (NewsUSA) -Right now, moving may be a little challenging as property value has gone up tremendously and the number of homes on the market is low. The next best option is to remodel and expand your home office, home gym, or add a patio for outdoor gatherings.

- (NewsUSA) -Right now, moving may be a little challenging as property value has gone up tremendously and the number of homes on the market is low. The next best option is to remodel and expand your home office, home gym, or add a patio for outdoor gatherings.

- Puradigm, a global leader in a new category of product, -- simultaneous air and surface purification -- has launched a residential version of their robust charged particle purification technology. Health-conscious families are taking notice.

- Puradigm, a global leader in a new category of product, -- simultaneous air and surface purification -- has launched a residential version of their robust charged particle purification technology. Health-conscious families are taking notice.

- Recent inflationary pressure, challenging financial circumstances and a looming rise in interest rates have made aspiring homeowners across the country feel like the dream of owning their home is slipping away from them. This situation may seem bleak, but San Francisco-based start-up, Divvy Homes offers aspiring homeowners another option to make their dreams a reality.

- Recent inflationary pressure, challenging financial circumstances and a looming rise in interest rates have made aspiring homeowners across the country feel like the dream of owning their home is slipping away from them. This situation may seem bleak, but San Francisco-based start-up, Divvy Homes offers aspiring homeowners another option to make their dreams a reality. - Good housecleaning has never gone out of style, but it has taken on a new priority in the wake of the ongoing coronavirus pandemic.

- Good housecleaning has never gone out of style, but it has taken on a new priority in the wake of the ongoing coronavirus pandemic.