How to Navigate Digital Assets for a Smarter Financial Future

(NewsUSA) - The digital age has ushered in rapid societal changes, including the financial system. Cryptocurrencies have emerged and evolved, and it’s no longer just early adopters who are integrating these digital assets into modern financial planning. Consumers of all ages and in all phases of life are exploring the market’s potential for their financial futures.

- The digital age has ushered in rapid societal changes, including the financial system. Cryptocurrencies have emerged and evolved, and it’s no longer just early adopters who are integrating these digital assets into modern financial planning. Consumers of all ages and in all phases of life are exploring the market’s potential for their financial futures.

Financial literacy: an ongoing process

According to a security.org study, nearly three in 10 American adults now own cryptocurrencies. The survey also reports that 40% of those owners lack confidence in the safety and security of the technology instrumental to the asset’s integrity, indicating a potential disconnect and knowledge gap that could be risky to some.

Education is crucial for building confidence in financial decision-making. Financial literacy evolves throughout life, initially focusing on saving and budgeting, then progressing to borrowing, credit, and debt management. As financial understanding deepens, investing becomes relevant, requiring knowledge of asset classes and their associated risks and rewards.

Cryptocurrencies are becoming widely accepted investment vehicles and one more way to diversify. Andrew Wiggins, forward for the Miami Heat who has partnered with Coinbase, explains, “I want to make sure my money is working in more places than just savings, stocks or real estate. Crypto is one way I’m doing that.”

Just as they would carefully evaluate stocks, bonds or mutual funds in traditional finance (the long-standing system of banks, stock exchanges, etc., involved in transactions), consumers need to do their research when it comes to cryptocurrency. Wiggins agrees, “I’ve taken the time to learn about it, I’ve asked the right questions, and I work with people that I trust.”

Decentralized finance presents opportunity

Cryptocurrency operates within a decentralized finance system, unlike government-issued fiat money. Cryptocurrencies are managed by global peer-to-peer networks using open-source software. Each has a blockchain, a transparent and cryptographically secured digital ledger of all transactions.

Cryptocurrency operates within a decentralized finance system, unlike government-issued fiat money. Cryptocurrencies are managed by global peer-to-peer networks using open-source software. Each has a blockchain, a transparent and cryptographically secured digital ledger of all transactions.

Like traditional financial assets, cryptocurrencies fluctuate in value, and a variety of platforms now help people incorporate digital money into their financial plans. "For the past decade, Coinbase has been dedicated to making crypto more accessible and secure for people around the world. As bitcoin and crypto moves further into the mainstream, Coinbase is ready to help consumers take part in this transformation," says Scott Shapiro, Senior Product Director of Coinbase.

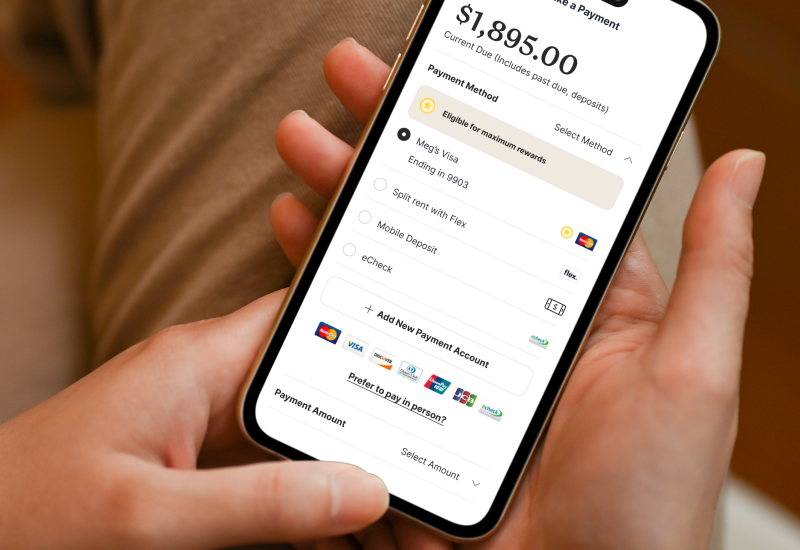

“A consumer only needs to create a wallet to start engaging with cryptocurrency, whether to save and invest or to trade and spend,” continues Shapiro. The Coinbase platform provides customers with clear overviews of their cryptocurrency holdings as well as analyst insights for informed decision-making. Plus, it offers features such as recurring buys to take advantage of investment concepts like dollar cost averaging.

Cryptocurrencies are touted for their openness, flexibility, speed and transparency, as well as their growth potential. One Bitcoin, for example, was valued at over $107,000 on June 16. However, these assets come with volatility and may not be suitable for risk-averse investors.

One of the ways Coinbase is reaching new audiences and introducing new consumers to crypto is through its official partnership with professional sports leagues and teams, which brings added brand visibility and engagement opportunities through in-arena signage and activations.

Taking an educated approach and balancing risk with reward are critical. As Wiggins notes, “Investing isn’t about chasing quick wins, it’s about building a smart, well-rounded portfolio that can grow despite market shifts. It’s about investing for the long term that will make sure my money grows along with the shifts of technology and the economy.”