(NewsUSA) - Like many veterans, Brian Owens, 53 from Kentucky, knows all too well that the invisible burdens of military service can linger long after the uniform comes off. For Brian, a U.S. Marine Corps veteran, it was his heart that felt the ongoing impacts the most.

- Like many veterans, Brian Owens, 53 from Kentucky, knows all too well that the invisible burdens of military service can linger long after the uniform comes off. For Brian, a U.S. Marine Corps veteran, it was his heart that felt the ongoing impacts the most.

Veterans face an increased risk of developing hypertension, commonly known as high blood pressure, a condition that affects an estimated 37% of the U.S. veteran population.1 Research from a large cohort study found that both combat exposure and combat injury were associated with higher odds of developing hypertension.2 For Brian, this is significant as men are already more likely to develop high blood pressure - 50.8% of adult men compared to 44.6% of women - and face greater cardiovascular risk over time.3

Treating hypertension early on is essential as the condition can increase the risk of heart attack, stroke, and other health concerns if left untreated.4,5 Brian’s treatment journey started like most do, being prescribed medication for high blood pressure and making changes to his diet and exercise routine. For Brian, the medication was helpful at first, but over time, his blood pressure increased, even with multiple prescriptions. “I was on five or six different medications at one point,” Brian recalls. "I was doing what I was supposed to, but I wasn’t getting better.”

Brian’s experience reflects a wider problem: controlling the “silent killer” is often elusive, and medication is not always enough. In fact, up to 50% of patients can’t maintain a routine to take medication within one year.6,7

After years of trying and seeing little progress, Brian started to feel helpless - like blood pressure control was out of reach. While working at Norton Healthcare, Brian ran into Dr. Matthew Sousa, an interventional cardiologist, who helped him seek answers for his uncontrolled high blood pressure. Dr. Sousa and Debbie Davis, a nurse manager at Norton Healthcare, helped him learn more about his treatment options and ultimately decide on a path forward.

“After telling Debbie and Dr. Sousa my story and concerns, they asked if I’d be open to a new procedure that could help,” Brian said. After discussing his options with his doctor and seeing if he would be a good candidate, Brian decided to move forward with a minimally invasive treatment called the SymplicityTM blood pressure procedure, which uses radiofrequency energy to calm overactive nerves near the kidneys that can contribute to high blood pressure.8

The Symplicity blood pressure procedure, which uses the Symplicity Spyral renal denervation system, can help reduce blood pressure numbers when other options, such as lifestyle changes and medications, haven’t worked. In fact, at three years, the average number of patients taking medication saw an 18.5 mmHg reduction in office blood pressure, although results may vary.9 The procedure may deliver sustained blood pressure reduction.**10, 11

Since having the Symplicity blood pressure procedure, Brian has experienced a reduction in his blood pressure.*** Now, Brian is sharing his story in hopes of helping others, especially fellow veterans. “It’s something a lot of veterans are dealing with, but don’t talk about,” he said. “If my experience can help someone else ask the right questions or explore new options, it’s worth it.”

Between volunteering with Toys for Tots, raising two daughters, and staying active through competitive shooting, Brian is embracing a new chapter with renewed energy and a healthier outlook on life.

To learn more about renal denervation and the Symplicity blood pressure procedure, visit beyondHBP.com. Risks associated with the Symplicity blood pressure procedure include, but are not limited to, pain and bruising. If you have high blood pressure, talk to your doctor about treatment options.

*Brian has received compensation in the past from Medtronic for sharing his experience with the Symplicity blood pressure procedure.

**Data available through three years.

***This patient testimonial is an individual’s experience and opinion. Not every person will experience the same results. The Symplicity procedure has known risks that should be considered in relation to the potential benefits of the procedure. People with higher blood pressure before the procedure may see greater reductions in blood pressure and a decrease in the need for blood pressure medication following the procedure. However, individual results may vary.

1 American Heart Association Newsroom. Joining Forces to Address Hypertension Among Veterans in Las Vegas. https://newsroom.heart.org/local-news/joining-forces-to-address-hypertension-among-veterans-in-las-vegas. Published March 8, 2023

2. Howard, J. T., Stewart, I. J., Kolaja, C. A., Sosnov, J. A., Rull, R. P., Torres, I., Janak, J. C., Walker, L. E., Trone, D. W., & Armenta, R. F. (2020). Hypertension in military veterans is associated with combat exposure and combat injury. Journal of hypertension, 38(7), 1293–1301. https://doi.org/10.1097/HJH.0000000000002364

3 Fryar, C. D., Kit, B. K., Carroll, M. D., & Afful, J. (2024, October). Hypertension prevalence, awareness, treatment, and control among adults aged 18 and over: United States, August 2021–August 2023 (NCHS Data Brief No. 511). National Center for Health Statistics. https://www.cdc.gov/nchs/data/databriefs/db511.pdf

4 Jones DW, et al. 2025 AHA/ACC/AANP/AAPA/ABC/ACCP/ACPM/AGS/AMA/ASPC/NMA/PCNA/SGIM Guideline for the Prevention, Detection, Evaluation, and Management of High Blood Pressure in Adults: A Report of the American College of Cardiology/American Heart Association Joint Committee on Clinical Practice Guidelines. J Am Coll Cardiol. 2025 Nov 4;86(18):1567-1678.

5 High blood pressure dangers: Hypertension’s effects on your body. Mayo Clinic. https://www.mayoclinic.org/diseases-conditions/highblood-pressure/in-depth/high-blood-pressure/art-20045868. Accessed Oct 16, 2024.

6 Jung O, Gechter JL, Wunder C, et al. Resistant hypertension? Assessment of adherence by toxicological urine analysis. J Hypertens. 2013 Apr;31(4):766-74.

7 Berra E, Azizi M, Capron A, et al. Evaluation of Adherence Should Become an Integral Part of Assessment of Patients With Apparently Treatment-Resistant Hypertension. Hypertension. 2016 Aug;68(2):297-306.

8 Coates P, Tunev S, Trudel J, Hettrick DA. Time, Temperature, Power, and Impedance Considerations for Radiofrequency Catheter Renal Denervation. Cardiovasc Revasc Med. September 2022;42:171–177.

9 Kandzari, DE. SPYRAL HTN-ON MED 3 Year Data. Transcatheter Cardiovascular Therapeutics (TCT) conference. October 2025.

10 Mahfoud F, Kandzari DE, Kario K, et al. Long-term efficacy and safety of renal denervation in the presence of antihypertensive drugs (SPYRAL HTN-ON MED): a randomised, sham-controlled trial. Lancet. April 9, 2022;399(10333):1401–1410.

11 Mahfoud F, Mancia G, Schmieder R, et al. Blood pressure and MACE reductions after renal denervation: 3-year Global Symplicity Registry results. Presented at PCR e-Course 2022."

US-SE-2500758 v 3.0

©2026 Medtronic. Medtronic, Medtronic logo, and Engineering the extraordinary are trademarks of Medtronic. All other brands are trademarks of a Medtronic company

Important Safety Information

The Symplicity™ blood pressure procedure (BPP) is a minimally invasive procedure approved to help lower high blood pressure. The procedure is approved as a complement to treatments you may already be trying, such as lifestyle modifications and high blood pressure medications that might not be adequately controlling your blood pressure.

Receiving the Symplicity BPP should be based on a joint decision between you and your doctor. Consider the benefits and risks of the device and procedure. Please talk to your doctor to decide whether or not the Symplicity BPP is right for you.

If you have a pacemaker or an ICD, your doctor will follow up with steps to take ahead of the procedure if you decide it is right for you.

At the time of your procedure, your doctor may detect certain anatomical conditions (e.g., your blood vessels are too big or too small) that do not allow the blood pressure procedure to continue.

You should not receive the procedure if you cannot tolerate medications that are required for the procedure, like atropine, nitroglycerin, systemic blood thinners, or certain pain medications. These medications are to help you in case your heart rate drops too low, you experience pain, or your blood vessels tighten during the procedure. You should not receive the procedure if you are pregnant.

The Symplicity BPP has not been studied in patients: • Who are breastfeeding • Who are under 18 years old • Who have isolated systolic hypertension (only the “top number” of your blood pressure is high) • Who have secondary causes of high blood pressure

• Who have had a renal stent placed less than 3 months prior to the procedure • Who had a prior minimally invasive treatment in their renal arteries (stenting, angioplasty, or prior renal denervation)

Potential risks of the Symplicity BPP (note that you may experience other problems that have not been previously observed with this procedure): • Allergic reaction to the imaging solution • Damage to your arteries • Future narrowing of your arteries • Arterio-enteric fistula (an abnormal connection between your aorta and your gastrointestinal tract) • AV fistula (an irregular connection between an artery and a vein) • Bleeding or blood clots • Bruising where the device enters your body (mild or severe) • Cardiac arrest or heart attack • Death • Deep vein thrombosis • Swelling • Slow heart rate • Infection • Low or high blood pressure • Damage to your kidneys that may cause one or both to stop working • Nausea or vomiting • Peripheral ischemia (lack of blood supply to your limbs) • Pulmonary embolism (a sudden block in your arteries that send blood to your lungs) • Pseudoaneurysm (blood collecting on the outside of a vessel wall causing a balloon-like widening) • Pain or discomfort • Skin burns from the failure of the equipment during the procedure • Exposure to radiation • Stroke

For further information, please call and/or consult Medtronic at 800-633-8766 or the Medtronic website at medtronic.com.

-

-  “When Waiting Becomes Life” by Jeff Deaton, MD

“When Waiting Becomes Life” by Jeff Deaton, MD  “Choosing Emotions: Thinking with Your Head and Acting with Your Heart” by D. Earl Johnston

“Choosing Emotions: Thinking with Your Head and Acting with Your Heart” by D. Earl Johnston “Summertime & Short Stories” by Stanislas M Yassukovich

“Summertime & Short Stories” by Stanislas M Yassukovich “Friday Nite at the Bucket of Blood Bar” by Bobby “Z” Zielinski

“Friday Nite at the Bucket of Blood Bar” by Bobby “Z” Zielinski

- The Department of Defense's, now renamed the Department of War by the current administration, acquisitions, notoriously sluggish and inefficient, is undergoing a change to make its historically sluggish acquisitions system more agile and responsive.

- The Department of Defense's, now renamed the Department of War by the current administration, acquisitions, notoriously sluggish and inefficient, is undergoing a change to make its historically sluggish acquisitions system more agile and responsive.

- While February is recognized as National Random Acts of Kindness month, Marine Toys for Tots knows kindness doesn’t have to be spontaneous to be powerful. That is why Toys for Tots celebrates Not So Random Acts of Kindness. The Program sees the impact of intentional acts of kindness every time someone chooses to give, volunteer, or lend support—not just during the holidays, but in the middle of ordinary days, busy seasons, and challenging moments.

- While February is recognized as National Random Acts of Kindness month, Marine Toys for Tots knows kindness doesn’t have to be spontaneous to be powerful. That is why Toys for Tots celebrates Not So Random Acts of Kindness. The Program sees the impact of intentional acts of kindness every time someone chooses to give, volunteer, or lend support—not just during the holidays, but in the middle of ordinary days, busy seasons, and challenging moments.

- Like many veterans, Brian Owens, 53 from Kentucky, knows all too well that the invisible burdens of military service can linger long after the uniform comes off. For Brian, a U.S. Marine Corps veteran, it was his heart that felt the ongoing impacts the most.

- Like many veterans, Brian Owens, 53 from Kentucky, knows all too well that the invisible burdens of military service can linger long after the uniform comes off. For Brian, a U.S. Marine Corps veteran, it was his heart that felt the ongoing impacts the most.

-

-  Religion is many things to many people, but it should never be a justification for hate and violence, and a little-known but impactful non-profit organization is hard at work to fight against the misrepresentation of religious beliefs.

Religion is many things to many people, but it should never be a justification for hate and violence, and a little-known but impactful non-profit organization is hard at work to fight against the misrepresentation of religious beliefs.

- Artificial intelligence (AI) continues to integrate into our daily lives with the rise of AI “companions,” that are designed to provide users with constant interaction and also may be hijacked by intelligence services from United States adversaries, according to experts at the Special Competitive Studies Project (SCSP), a nonprofit and nonpartisan initiative with a goal of making recommendations to strengthen America's long-term competitiveness in AI.

- Artificial intelligence (AI) continues to integrate into our daily lives with the rise of AI “companions,” that are designed to provide users with constant interaction and also may be hijacked by intelligence services from United States adversaries, according to experts at the Special Competitive Studies Project (SCSP), a nonprofit and nonpartisan initiative with a goal of making recommendations to strengthen America's long-term competitiveness in AI. -

-  “The Terminal Gene” by John H. Thomas

“The Terminal Gene” by John H. Thomas "Whiteout" by Lynette Eason and Dani Pettrey

"Whiteout" by Lynette Eason and Dani Pettrey “You Know FAT Mary: Achieving Weight Loss and Optimal Health. My Journey. My Discoveries.” by Mary H. Putre

“You Know FAT Mary: Achieving Weight Loss and Optimal Health. My Journey. My Discoveries.” by Mary H. Putre “Look Twice: Your Guide to Staying Safe in an Unsafe World, Volume I” by Tim Beard

“Look Twice: Your Guide to Staying Safe in an Unsafe World, Volume I” by Tim Beard

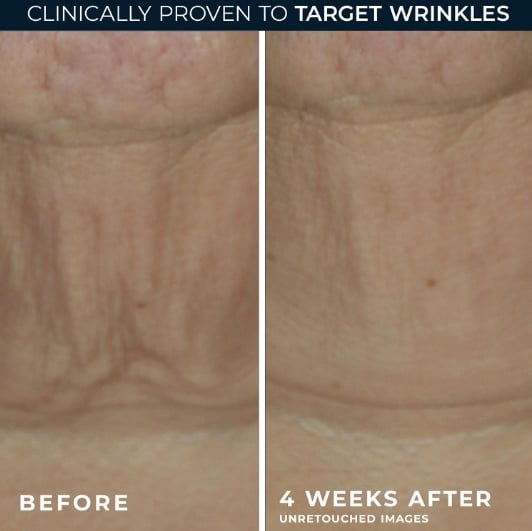

- The skincare world is officially over pricey corrective measures. Instead, we’re moving toward structural integrity—targeting the skin’s framework to stop the look of sagging before it starts, without breaking the bank. Leading the "Pre-Tox" charge is legacy powerhouse RoC Skincare, whose Derm Correxion Firming Serum1 Stick quickly secured the spot as the #1 face & neck serum. Why? Because it delivers a lifted look without a single needle in sight.

- The skincare world is officially over pricey corrective measures. Instead, we’re moving toward structural integrity—targeting the skin’s framework to stop the look of sagging before it starts, without breaking the bank. Leading the "Pre-Tox" charge is legacy powerhouse RoC Skincare, whose Derm Correxion Firming Serum1 Stick quickly secured the spot as the #1 face & neck serum. Why? Because it delivers a lifted look without a single needle in sight.

-

-  “Lowdown” by Anthony Schneider

“Lowdown” by Anthony Schneider “Boys Will Be Men: 8 Lessons for the Lost American Male” by Vince Benevento, LPC

“Boys Will Be Men: 8 Lessons for the Lost American Male” by Vince Benevento, LPC “DoubleHelix" (Book One in the Helix Project) by J.L. Calder

“DoubleHelix" (Book One in the Helix Project) by J.L. Calder "AROC Adventures – ABCs of Safe Web Surfing: Essential Online Safety Tips for Your Child's First Device" by C.D. Richardson

"AROC Adventures – ABCs of Safe Web Surfing: Essential Online Safety Tips for Your Child's First Device" by C.D. Richardson - Making the nursery and other children’s spaces safe, healthy, and beautiful is every parent’s goal. Strong and natural, American Hardwoods™ can help achieve it: from the reassuring solidity of a crib to the cozy ease of bunk beds, from the satisfying feel of carved toys to the charm of kid-size furniture, and from the tidiness of well-conceived storage to the warmth of architectural millwork. “Materials matter for those who matter most,” says Ian Faight of the

- Making the nursery and other children’s spaces safe, healthy, and beautiful is every parent’s goal. Strong and natural, American Hardwoods™ can help achieve it: from the reassuring solidity of a crib to the cozy ease of bunk beds, from the satisfying feel of carved toys to the charm of kid-size furniture, and from the tidiness of well-conceived storage to the warmth of architectural millwork. “Materials matter for those who matter most,” says Ian Faight of the